What is a Limited Partnership?

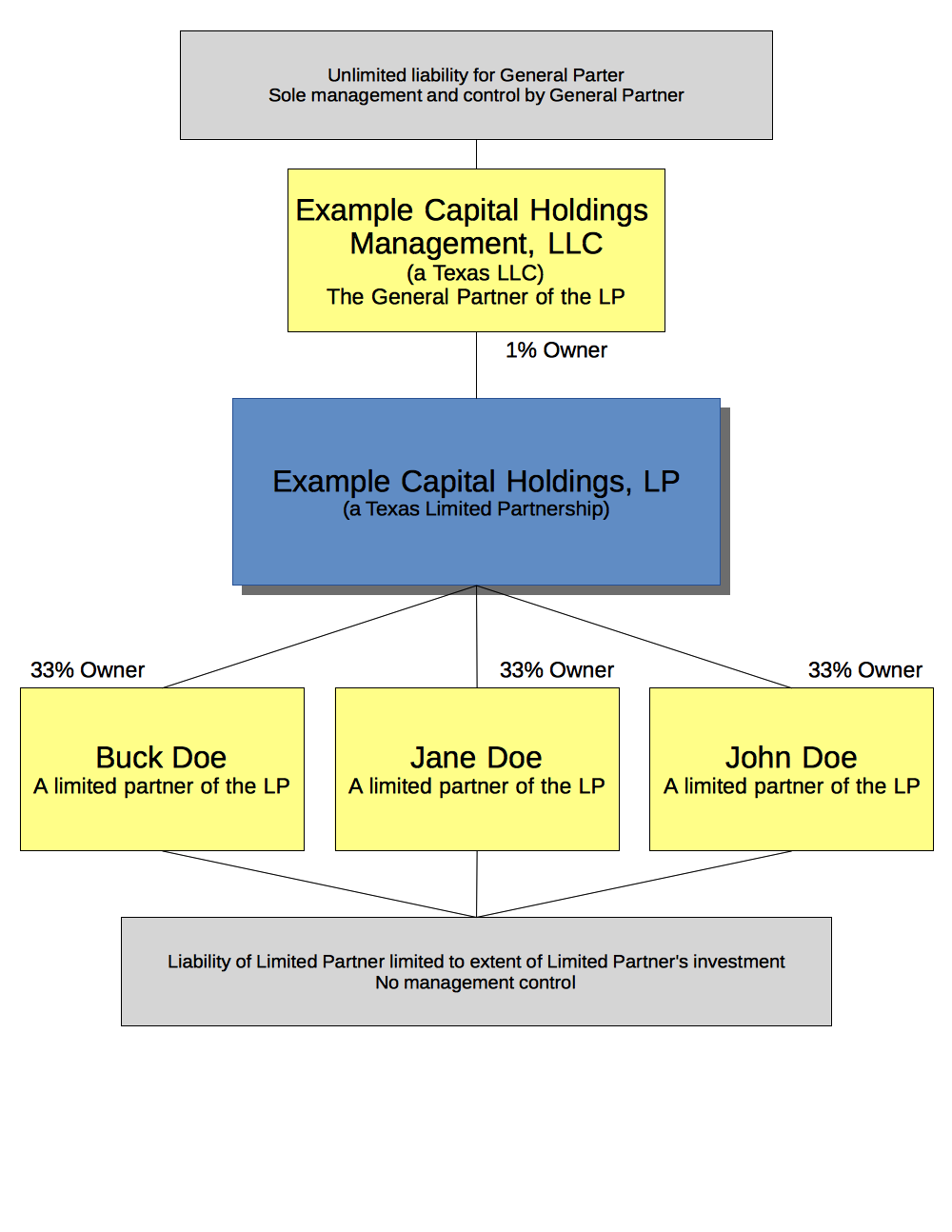

A limited partnership ("LP" for short) is a special kind of partnership characterized by having one or more general partners and one or more limited partners. A general partner is responsible for managing the LP and has unlimited personal liability on behalf of the LP. A limited partner may not participate in the management of the LP but also has their liability limited to their investment in the LP. For example, if the LP's activities kill a child, the general partner can be held fully liable for it, but the limited partners' liability is limited solely to the amount they put into the business and the growth of that money.

This tends to be very useful to bring talent and capital together. Talent being the general partner and capital being the limited partner(s).

Because general partners are personally liable for the LP's debts, the general partner is typically formed as another limited liability entity, usually an LLC, Corporation, or even another LP. Because of this, LPs cost more than a single LLC structure. You need to pay for the partnership, a filing fee to the state for the LP, and then you need to form an LLC and pay another filing fee to the state for the LLC. You'll also have a tax return for the LP as well as a tax return for the GP.

LPs also many times have securities regulation issues as well as investment adviser registration issues depending on the kind of business they will pursue and/or whether they are considered investment companies under federal law. It's very important to pay double attention to the kinds of investments managed by the GP; there are many traps and pitfalls that the manager can run into if they are managing securities instead of their own active business. For example, most regulated hedge funds, private equity funds, and venture capital funds are structured as a Limited Partnership.

Why use an LP then? Typically they are used to attract investors; the investors like knowing that their liability is limited to their investment. The general partners like knowing they maintain control of the company. Also, limited partners typically don't pay any self employment (SECA) tax on their share of income from the company. Further, Rule 502 of Regulation D gives favorable audit treatment to limited partnerships in private offerings under Rules 505 and 506 of Regulation D.

In TX, some LPs will have franchise tax advantages; however, many of the past advantages no longer exist. But, particularly for oil and gas investments, a proper LP structure may save TX franchise taxes.