I'm in a high risk business, now what?

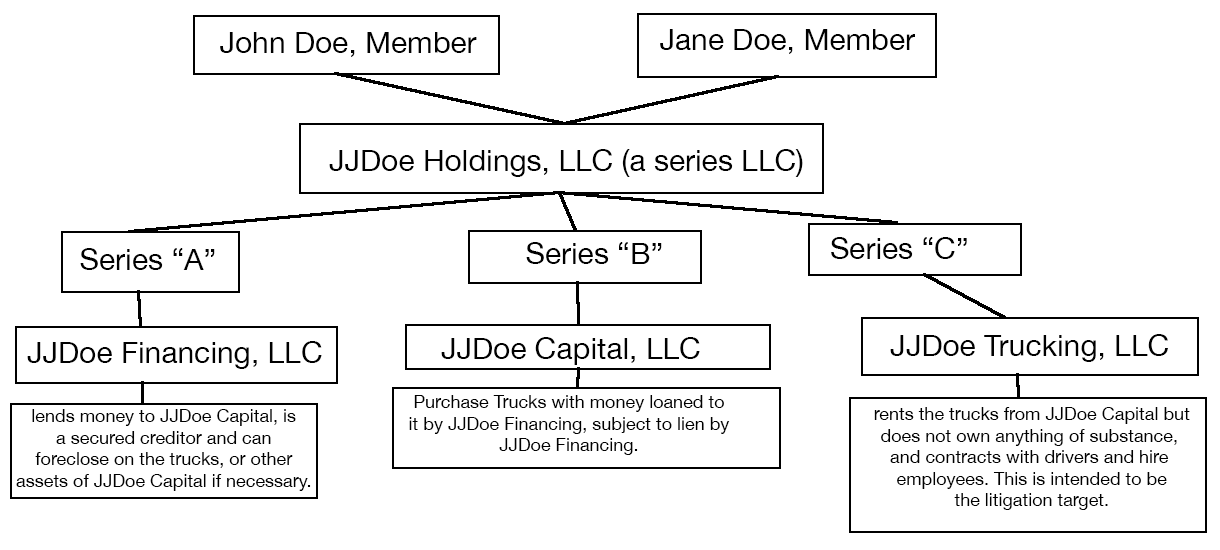

Let's look at an example business: John and Jane Doe run a trucking business that transports hazardous chemicals over interstate freeways using 18-wheeler semi-trucks. They have numerous potential liability sources including traffic accidents, chemical spills, and internal employee issues / harassment / discrimination claims. These risks can be minimized and compartmentalized with a four-company strategy.

Take a look at our diagram (click to enlarge):

The holding company is nice to have but is not absolutely essential to this strategy. The main strategy are the three different lower level LLCs. Financing is usually a traditional LLC, Capital is usually a series LLC, and Trucking is usually a traditional LLC. The basics are that the Financing LLC provides secured lending to the Capital LLC. Capital LLC borrows from Financing LLC and gives a mortgage / lien / security interest on the trucks. This means if Capital breaches the loan agreement, Financing can foreclose on the trucks. Capital leases the trucks to Trucking LLC. If Trucking LLC violates the lease, then Capital LLC can foreclose on the trucks. Trucking LLC is the LLC that interacts with the public and signs contracts and does the work of the business. If trucking is sued, Capital forecloses.

If for some reason the Plaintiff can pierce and sue Capital, Financing also can foreclose. It's very rare that Financing is going to incur any major liabilities as its only business activities are lending money to Capital. With this structure it may be possible to not lose a single large capital asset in the event of a lawsuit against Trucking, LLC.

Another strategy is to use three different trusts for the managers of each of the LLCs as well as different sounding names for each of the LLC businesses so it makes it harder for a potential Plaintiff's lawyer from determining if the ownership is related.

This same strategy can be implemented with any large capital asset or equipment as well, provided there are no specific laws against such a structure.